For people that may need money for residence renovations over an extended period, they may be much better off refinancing their current home mortgage for a larger quantity, Grabel states. For short-term financings, HELOCs are an affordable method to borrow, he claims. Unlike a HELOC, where a credit line is readily available at any time, a residence equity car loan amount is established upfront as well as the debtor gets it as a round figure.

Offered via financial institutions, credit unions, as well as online lending institutions, the best personal fundings are available for up to $100,000. Highly-qualified borrowers can often snag a low interest rate.

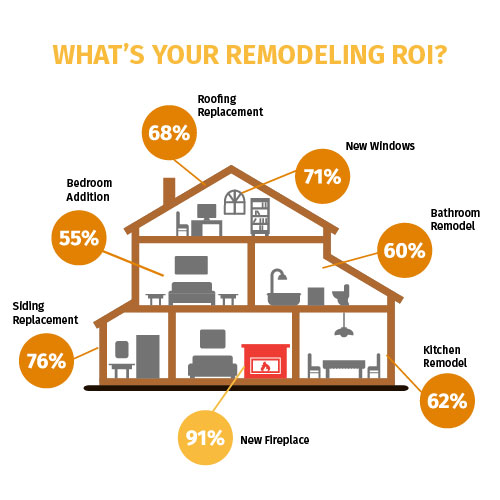

Residence Remodellings Returning Worth.

The smartest means to make a decision just how much to spend on a home remodelling is to check out your present regular monthly spending plan and also go from there. To take control of your house improvement spending plan, you require a strategy. If you want to complete a stunning renovation without declaring bankruptcy, we'll reveal you just how to develop a clever spending plan as well as make clever choices that include real worth to your house. And also, by the end of the term, "The funding must be paid in full.

But you'll wish to see to it you can repay your equilibrium over a short amount of time, because credit cards normally include greater rate of interest than other sorts of financing. A HELOC is an additional method to obtain against the the value of your residence, however unlike a refinance, it doesn't settle the initial home loan. Instead, you get a line of credit history-- usually as much as 80% of your residence's worth, minus the quantity of your mortgage. A house equity funding is the timeless means to fund residence improvements. Expert Affairs likewise offers cash-out refinance car loans, which guarantee 100 percent Learn here of the worth of your residence.

When Is It A Good Concept To Fund Residence Remodellings?

On the occasion that you can not pay, the VA finance warranty is the "insurance policy" it gives to your loan provider. One type of federal government financing is a HUD Title 1 Building Improvement Funding. You can obtain approximately $25,000 without having any kind of equity in your home. This is an excellent choice if you have actually recently acquired your home and require to make some upgrades. Nevertheless, the money kitchen remodeling Glenview should approach renovations that boost the livability of the home, and some upgrades may not certify. If you're making minor updates to your residence, like upgrading a washroom vanity or setting up a brand-new wardrobe system, utilizing your credit card http://cashmufe623.simplesite.com/448666686 might be one of the most effective ways to finance house improvements.

- You don't set up security for an unsecured individual funding, so you do not take the chance of losing your home or vehicle in case of default.

- Those without equity or refinance alternatives could use an individual financing or credit cards to fund house renovations instead.

- If you can see your home's capacity, yet not how to pay for it, there are several choices consisting of restoration fundings and house equity finances of lines of credit.

- An EEM requires a resolution that your house fulfills Fannie Mae's strict energy-efficiency requirements.